How a Diversified 401(k) Can Cut Your Taxes

Time to read 3 Minutes

How a Diversified 401(k) Can Cut Your Taxes

As a business owner, saving for retirement isn’t just about putting money away—it’s about doing it smart. And one of the smartest moves? Diversifying your 401(k).

By using both a Traditional 401(k) and a Roth 401(k), you can lower your lifetime tax bill and boost your retirement income. Let’s break it down.

What Is a Diversified 401(k)?

A diversified 401(k) means splitting your retirement savings between:

- Traditional 401(k) – You contribute pre-tax dollars now and pay taxes later when you withdraw.

- Roth 401(k) – You pay taxes now, but your withdrawals (including earnings) are tax-free in retirement.

Using both gives you more control over your taxes now and later.

Why Use a Traditional 401(k)?

With a traditional 401(k), you don’t pay taxes on the money you contribute today. That means: lower taxable income now, more money invested to grow over time, and taxes only when you withdraw in retirement.

Why Use a Roth 401(k)?

Roth 401(k)s flip the script. You pay taxes now, but:

- Your money grows tax-free

- You pay zero taxes when you withdraw

- No income limits like Roth IRAs

- No required withdrawals if you roll it into a Roth IRA

- Higher contribution limits than Roth IRA (up to $23,500 more per year in 2025)

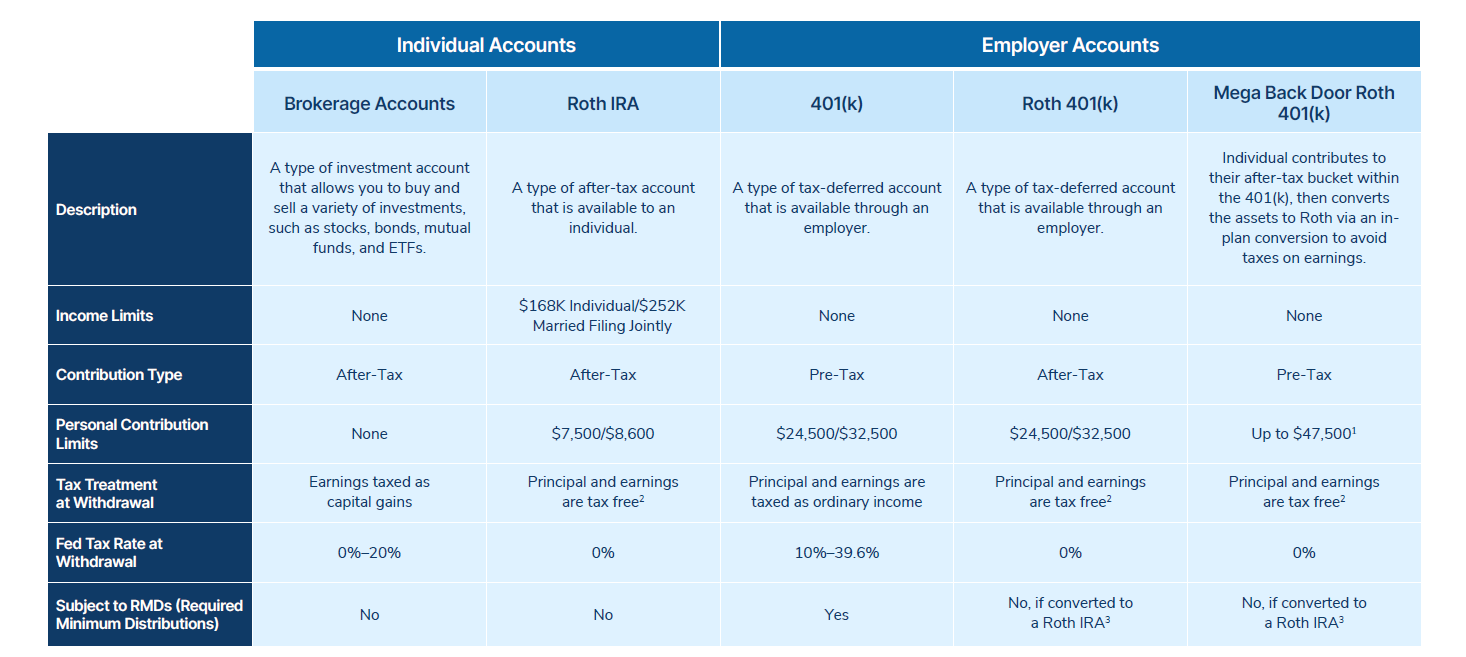

This is perfect if you expect to be in a higher tax bracket later—or just want tax-free income in retirement. You can see how tax treatments break down in the table below.

Retirement Account Tax Treatments

Click here to download a copy of this chart.

Why Diversification Works

You already diversify your investments—stocks, bonds, etc. So, why not diversify your tax strategy too?

Having both types of accounts lets you:

- Choose which account to pull from based on your tax situation

- Reduce your tax bill in retirement

- Keep more of your money working for you

Quick Retirement Account Comparison

Traditional 401(k)

• Pay Taxes Now: No

• Pay Taxes Later: Yes

• Grows Tax-Deferred

• No Income Limits

Roth 401(k)

• Pay Taxes Now: Yes

• Pay Texas Later: No

• Grows Tax-Free

• No Income Limits

Roth IRA

• Pay Taxes Now: Yes

• Pay Taxes Later: No

• Grows Tax-Free

• Has Income Limits

How to Set It Up

Most 401(k) providers offer both traditional and Roth options. You can choose how much to put in each account, adjust your mix over time, and roll over your Roth 401(k) to a Roth IRA when you retire. It’s flexible, simple, and powerful.

Let’s Build a Smarter Retirement Plan

At Fisher\SMB, we help small business owners like you build retirement plans that work harder for you and your team. Contact us to chat about adding Roth options to your 401(k).

Learn More About

Tax Diversification

Tax Diversification Case Study

Read this case study to learn how to leverage a Roth 401(k) to reduce taxes and increase retirement savings.

Roth 401(k) Guide

You diversify your investment portfolio. It also makes sense to diversify your tax liability. Learn how employees can use a Roth 401(k) to create tax diversification.

5 Reasons Employees Love Roth 401(k)

A Roth 401(k) offers tax-free growth, higher contribution limits, and more flexibility in retirement. Here are 5 reasons your employees will love it—and why your company should offer one.