You Don’t Have to Manage Your Plan Alone

Thank You

Click the button below to begin your download, please contact us if you have any questions.

Accountability isn’t just our feeling – it’s our legal duty.

Fisher\SMB™ is a top 1% CEFEX® certified fiduciary plan advisor dedicated to serving small and mid-sized businesses.

Are you prepared to accept personal liability for your company’s retirement plan?

As someone who makes decisions for your company’s retirement plan, you’re vulnerable to fiduciary risk. This means that administrative, operational, and investment management duties must be carried out diligently and in the best interest of employees; otherwise, you’re personally liable. That’s a big responsibility, but you do have options. Many business owners and HR professionals aren’t investment experts. To reduce their risk and ensure the health and safety of their retirement plan, many businesses outsource fiduciary responsibility.

A Trusted Decision Maker

A fiduciary has important decisions to make. Employees in the retirement plan are counting on the fiduciary to protect their savings and provide investments that are managed with their best interest in mind.

Fisher\SMB’s Rigorous Lineup

We use a multi-level process to analyze and monitor more than 25,000 funds. The result? The best-of-the-best investments for your retirement plan.

| Visual | Audio |

|---|---|

| Dots and Title appear. “25,000+ initial fund possibilities | Music Plays |

| Funnel Builds from top down, swipe from right, then text appears next to section. “Category Selection” is written on the first section of the funnel. “Select appropriate investment strategies” appears next to the funnel. | Music Plays |

| The background builds leading to next section of funnel, text appears on the right and continues until funnel is built | Music Plays |

| Continuous Process Review appears and starts to rotate counter clockwise. The title of each section of the funnel read “Active or passive”, “Fund analysis” and “FIT Review”. Next to each read respectively, “Add value thorugh active or passive management,” “Identify best-in-class funds,” and “Curate a fund lineup to meet client objectives. | Music Plays |

| Dots animate and fall through the funnel | Music Plays |

| “Select Funds” Appears at the bottom of the funnel and hangs on balls falling for 5 seconds | Music Plays |

| Investing in securities involves the risk of loss. Intended for use by employers considering or sponsoring retirement plans; not for personal use by plan participants. Fisher Retirement Solutions™, Fisher\SMB™, FisherSMB™, and all related logos and designs are trademarks of Fisher Retirement Solutions, LLC, which is not connected to Fisher Investments. ©2025 Fisher Retirement Solutions | Music Fades out |

Tracking Your Responsibilities

The amount of fiduciary responsibility you take on is up to you. But if you’re not prepared for time-consuming and potentially confusing plan management tasks, you can work with a retirement plan professional, who can take on the burdens and liabilities of a fiduciary.

Hiring a CEFEX® certified ERISA 3(38) Investment Manager like Fisher\SMB™ reduces your liability for investment decisions and takes work off your plate so you can focus on running your business.

Understanding Your Risk

Fiduciary mismanagement can cost a business tens of thousands of dollars in legal fees and fines. The better you understand your risk, the more you can do to minimize it.

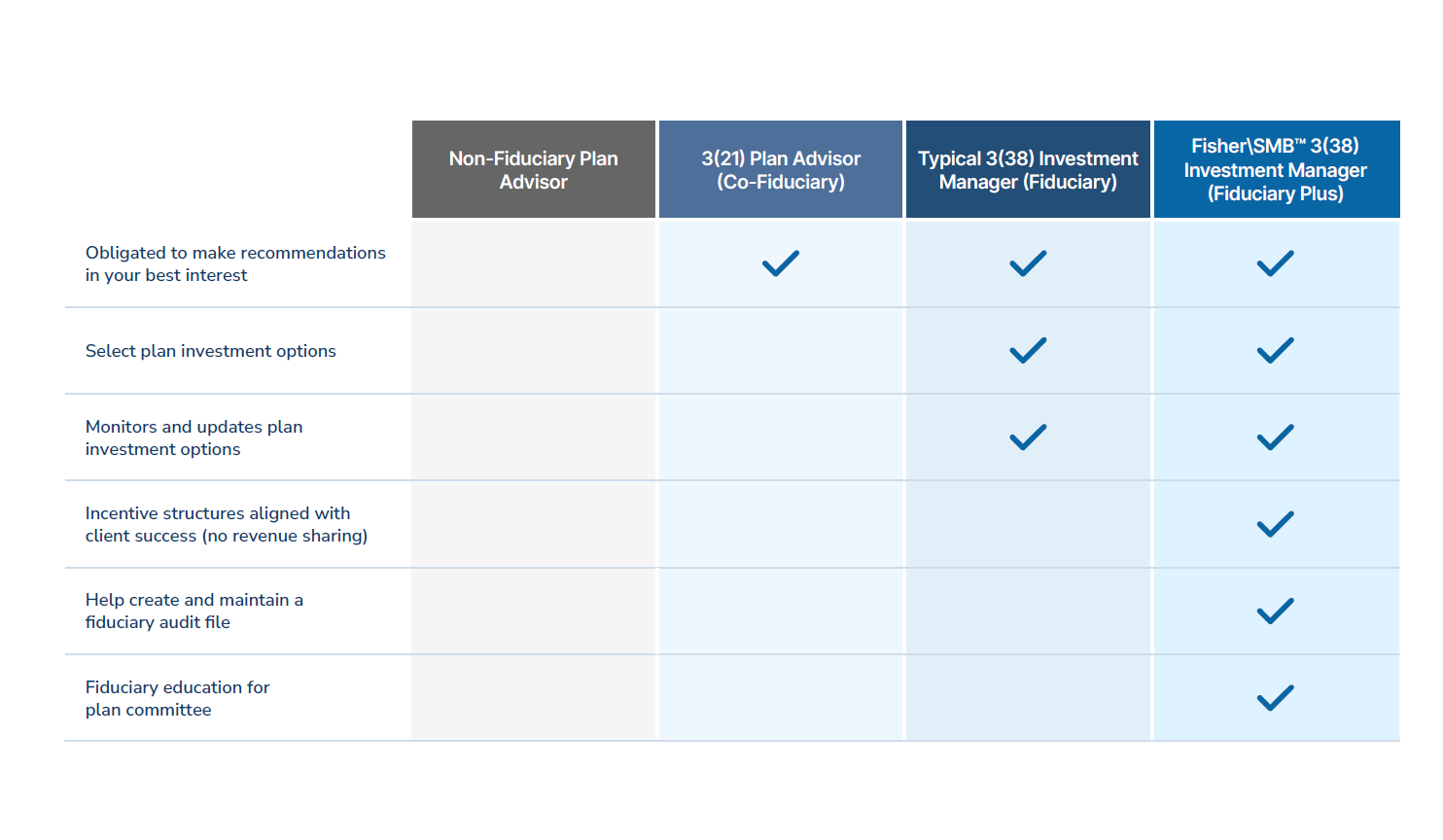

Compare Fiduciary Options

3(21) Investment Advisor

A co-fiduciary who makes investment recommendations. The sponsoring company remains liable for decisions.

3(38) Investment Manager

A fiduciary who takes legal responsibility for investment management decisions. The sponsoring company is not liable for the manager’s decision.

CEFEX® Investment Manager

A CEFEX® certified fiduciary (awarded to the top 1% of plan advisors) takes legal responsibility for investment management decisions. The sponsoring company is not liable for the manager’s decisions.

Downloadable Checklist

Don’t Manage Your Plan Alone

Every retirement plan has a plan fiduciary — someone who’s responsible for administrative, operational, and investment management. If these responsibilities aren’t carried out diligently and in the best interest of employees, the fiduciary is personally liable. Download the checklist to learn how to manage fiduciary risk.

Frequently Asked Questions About Fiduciaries

The word “fiduciary” is legalese, but the concept is simple. If you’re a decision maker on your company’s 401(k) plan, you’re responsible for doing right by your employees. Learn more about the responsibilities that come with being a fiduciary and how to manage them.

If you make decisions for your company’s 401(k), you are a fiduciary. Every retirement plan needs at least one trusted, reliable fiduciary, someone who works in the best interest of the plan and its participants. To better understand your role as a fiduciary, consider these common questions.

As a fiduciary, you’re expected to act prudently and to consider how your decisions will affect employees. It also means you need to have administrative systems in place that document your decisions and communicate important details to employees. If you don’t meet your fiduciary responsibilities, you may be liable for harm caused by your decisions. Fiduciary mismanagement could cost you and your company tens of thousands of dollars in legal fees and fines.

Being a fiduciary means you’re liable if something goes wrong with your plan. When considering your liability, understand:

- Ignorance is no defense in a court of law.

- A fiduciary is personally liable to make good on plan losses due to an ERISA provision breach.

- The Department of Labor may assess a civil penalty equal to 20% of the recovery amount.

- Individuals may be fined up to $100,000 and jailed up to 10 years for ERISA violations.

- Companies may face up to $500,000 in fines for ERISA violations.

There are three types of retirement plan fiduciaries:

- A 3(38) investment manager is a fiduciary who is responsible for plan investment decisions. Your responsibility is to select and oversee your fiduciary.

- A 3(21) investment advisor is a co-fiduciary, which means they make investment recommendations, but the ultimate decision is up to you and you’re still responsible and liable for the decisions made.

- A 3(16) administrative fiduciary is responsible for fulfilling specific administrative duties on behalf of the plan. For example, a 3(16) administrative fiduciary signs and files Form 5500 with the Department of Labor and approves loans. However, you are still responsible and liable for the decisions made.

Yes, you can outsource many fiduciary duties, including investment management and administrative tasks. Outsourcing fiduciary duties can reduce both your liability and administrative burden. Some retirement plan providers, third-party administrators, or record keepers offer fiduciary services. If you consider outsourcing with a fiduciary, find out exactly what services they offer and what responsibilities remain with you. Some leave critical duties up to you. Watch out for fiduciaries who:

- Have incentive structures that include revenue sharing or kickbacks.

- Don’t help and maintain a fiduciary audit file.

- Don’t offer fiduciary education for your plan committee.

As a 3(38) investment manager, Fisher\SMB maintains the highest fiduciary standards and will partner with you to make sure you, your company, and your employees are protected.

Contact Us

One of our 401(k) business specialists would love to talk to you about your company’s retirement plan needs.

Call Us

(888) 674-4504