Plan features typically reserved for larger companies.

We give smaller businesses access to the same plan features and investment options that larger companies enjoy.

A Well-Built Retirement Plan

There are many ways to tailor a retirement plan to meet your organization’s unique business needs.

Add-On Plans

Employers can add supplement plans—like Cash Balance, ESOP, Nonqualified Deferred Compensation (NQDC), and more—to help employees save even more for retirement and to increase business tax advantages.

Roth Contributions

A Roth option allows you and your employees to pay taxes on your retirement savings now, instead of when you take distributions in retirement. Providing a Roth option may reduce the overall taxes paid over the life of the investment and is an important part of a tax diversification strategy.

| Visual | Audio |

|---|---|

| A title screen appears, “Tax Diversification.” A woman begins to speak. | Woman: You diversify your investment portfolio. It makes sense to also diversify your tax liability |

| A bar graph appears on the screen with one bar being Tax Deferred 401k and the other After Tax Roth. The woman continues to speak | Woman: Adding a Roth feature allows participants to contribute to two types of accounts a tax deferred 401 K and an after Tax Roth account |

| A box appears reading “More retirement income.” A pair of binoculars appear with a box reading “Fewer taxes.” The woman continues to speak. | Woman: enabling participants to contribute to tax deferred and after tax accounts creates tax diversification, which can increase retirement income and can reduce overall taxes paid over the life of the investment. Schedule a consultation to learn more about how Fisher can help your employees save more toward their retirement goals. |

| A closure screen appears, “Fisher\SMB™ Investing in securities involves the risk of loss. Intended for use by employers considering or sponsoring retirement plans; not for personal use by plan participants. Fisher Retirement Solutions™, Fisher\SMB™, FisherSMB™, and all related logos and designs are trademarks of Fisher Retirement Solutions, LLC, which is not connected to Fisher Investments. ©2025 Fisher Retirement Solutions | [Music] |

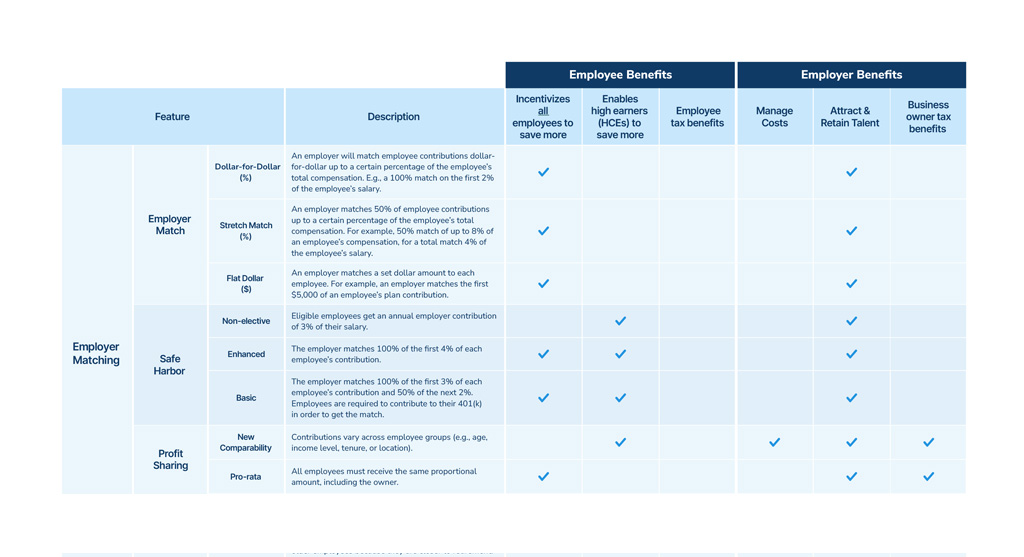

Employer Contributions

- Match: Incentivizes employees to contribute.

- Safe Harbor: A type of contribution that helps an employer pass compliance testing.

- Profit Sharing: A type of contribution via an add-on plan.

Plan Parameters

There are four main parameters that plan sponsors can designate for their plan.

Vesting: Decide how quickly your employees fully own employer contributions.

Automatic Enrollment/Escalation: Determine whether employees will be automatically enrolled in the plan and registered for annual contribution increases.

Loans: Enable participants to borrow against their vested balance.

| Visual | Audio |

|---|---|

| Fisher\SMB™ | Upbeat music |

| “We can help you improve your plan.” Is shown in blue text over a white screen. Directly above the words is a circle with the outline of a speedometer. | Female Voice: “We act as a consultant and can help you improve your plan. |

| “We can help you improve your plan.” fades away and new text fades in “Some of the plan features we’ll analyze include: | Fisher will analyze your current plan features and help you identify improvement opportunities to improve plan outcomes for plan participants, the business, and the business owner. |

| A circle with a clock outline fades onto the screen with the text “Eligibility” under. | Some of the plan features that we analyze include: Eligibility- which determines which employees can join the plan and when. |

| A circle with the outline of safe fades onto the screen with the text “Vesting”. | Vesting- which determines how quickly your employees fully own employer contributions. |

| A circle with a line graph fades onto the screen with the text “Automatic Enrollment and Escalation”. | Automatic enrollment and escalation- which determine whether employees will be automatically enrolled in the plan and registered for annual contribution increases. |

| A circle with a hand and a dollar sign fades onto the screen with the text “Loans”. | Loans- enable participants to borrow against their vested balance. Enabling loans can improve employee participation. |

| Fisher\SMB™ | Contact Fisher for a free plan analysis today. |

| Investing in securities involves the risk of loss. Intended for use by employers considering or sponsoring retirement plans; not for personal use by plan participants. Fisher Retirement Solutions™, Fisher\SMB™, FisherSMB™, and all related logos and designs are trademarks of Fisher Retirement Solutions, LLC, which is not connected to Fisher Investments. ©2025 Fisher Retirement Solutions | Music Fades Out |

Downloadable Chart

Compare Popular Features

Customize your employer-sponsored retirement plan to meet the unique needs of your business.

- Attract and retain talent

- Reduce cost

- Increase owner and employee tax savings

- Improve employee participation and savings rates

Auto Enrollment Case Study

Increase 401(k) Savings Rates with a Simple Plan Feature

See how this 50-employee tech company improved plan participation and employee savings, while also allowing owners to increase their own contributions.

Contact Us

One of our 401(k) business specialists would love to talk to you about your company’s retirement plan needs.

Call Us

(844) 238-1247