3(21) vs. 3(38) Fiduciary Services

Time to read 3 Minutes

Running a company 401(k) plan is a big responsibility. Your team is counting on you to offer smart, low-cost investment options that help them save for the future. But here’s the good news: you don’t have to do it alone.

Let’s break down two types of fiduciary support—3(21) and 3(38)—so you can decide what’s best for your business.

What’s a Fiduciary?

A fiduciary is someone who is legally responsible for making decisions in the best interest of others. In the case of a 401(k) plan, that means choosing and managing investments that help your employees grow their retirement savings.

Under a law called ERISA (Employee Retirement Income Security Act), you’re a fiduciary if you:

- Make decisions about how the plan is run

- Manage the plan’s money or investments

- Give investment advice for a fee

Even if your job title doesn’t say “fiduciary,” your actions might make you one. And that means you could be personally responsible if something goes wrong.

What Is ERISA?

ERISA is a federal law that protects people in retirement and health plans. It sets rules for how plans should be managed and who’s responsible for what. Two key parts of ERISA are:

- Section 3(21): Defines the term fiduciary

- Section 3(38): Defines requirements of an investment manager

Are You Personally Liable?

If you’re a fiduciary, you are responsible for creating and maintaining a documented, prudent process to select, monitor, and update investments that are appropriate for the plan. If you fail to do this, you could be held personally responsible for losses. That’s why many companies choose to work with outside experts.

What Is a 3(21) Investment Advisor?

A 3(21) advisor helps you choose investments but doesn’t make final decisions. You stay in control and keep the legal responsibility. This means liability for selection, monitoring, and updating the plan’s investments would stay with you. This is a good option if you want expert advice but still want to call the shots.

What Is a 3(38) Investment Manager?

A 3(38) manager takes full control of the investment lineup. They choose, monitor, and update the funds for you. Your job is to pick a good manager and check in on their performance and fees. If your goal is to fully minimize your fiduciary liability, consider hiring a 3(38) investment manager.

What’s the Difference Between a 3(21) Investment Advisor vs. a 3(38) Investment Manager?

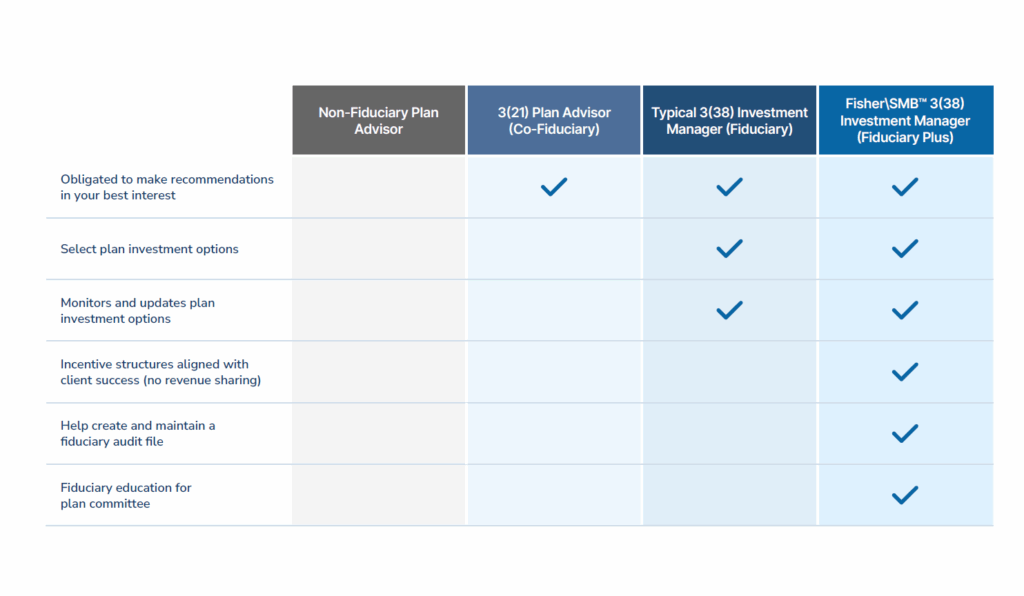

The chart below underscores the key differences between a 3(21) fiduciary and a 3(38) investment manager. It also shows how Fisher\SMB goes beyond the minimum standards of a typical fiduciary.

Regardless of the type of fiduciary support you choose, you’re still responsible for prudently selecting the right plan advisor and monitoring their work.

What Should I Consider When Hiring a 3(21) or 3(38) Fiduciary?

Think about how much control you want and how much risk you’re willing to take. If you’re confident in managing investments, a 3(21) adviser might be enough. But if you’d rather hand off the responsibility, a 3(38) manager could be the safer bet.

Either way, you’re still responsible for picking the right partner and keeping an eye on their work.

Why Fisher\SMB?

Fisher\SMB has helped 1,700+ clients enhance their retirement plans by providing high-quality fiduciary services. Whether you want guidance or full support, we’re here to help you protect your company and your employees.

Ready to learn more? Contact us today and let’s build a smarter retirement plan together.

Learn More about

Reducing Fiduciary Risks

Fiduciary Services

Many business owners and HR professionals aren’t investment experts. To reduce their risk and ensure the health and safety of their retirement plan, many businesses outsource fiduciary responsibility.

Understanding Your Risk

Fiduciary mismanagement can cost a business tens of thousands of dollars in legal fees and fines. Download this PDF to learn more.

Don’t Manage Your Plan Alone

Download the checklist to learn how to manage your fiduciary risk and avoid costly fiduciary mistakes.