More Savings, Fewer Taxes: The Powerful 401(k) Tax Benefit for Business Owners

Time to read 4 Minutes

If you’re a business owner, you work hard—and you deserve to keep more of what you earn. What if there was a way to potentially save hundreds of thousands for retirement and cut your tax bill at the same time?1

Good news: there is. It’s called the Tax Advantage Layer Cake, and it’s a powerful strategy that helps business owners save big—both now and later.

What Is the Tax Advantage Layer Cake?

It’s a smart combo of two retirement plans: a Safe Harbor 401(k) and a Cash Balance Plan. Together, they let you save more for retirement while reducing your taxable income. That means you can keep more of your money today and build a bigger nest egg for tomorrow.

This strategy works best for:

- High-earning business owners

- Fewer than ~15 employees per owner

- Owners who are older than their employees

- Businesses with steady profits

How Much Can You Save?

Let’s break it down:

- In 2025, if you’re 50 or older, you can save up to $77,500 in your 401(k) through salary deferrals, catch-up contributions, employer match, and profit sharing. ($70,000 if you’re under 50)

- With a Cash Balance Plan added, you could save up to $480,500 per year—pre-tax!

That’s right. You could move nearly half a million dollars from your business profits into retirement savings and cut your tax bill at the same time. See the 2025IRS contribution limits by age.

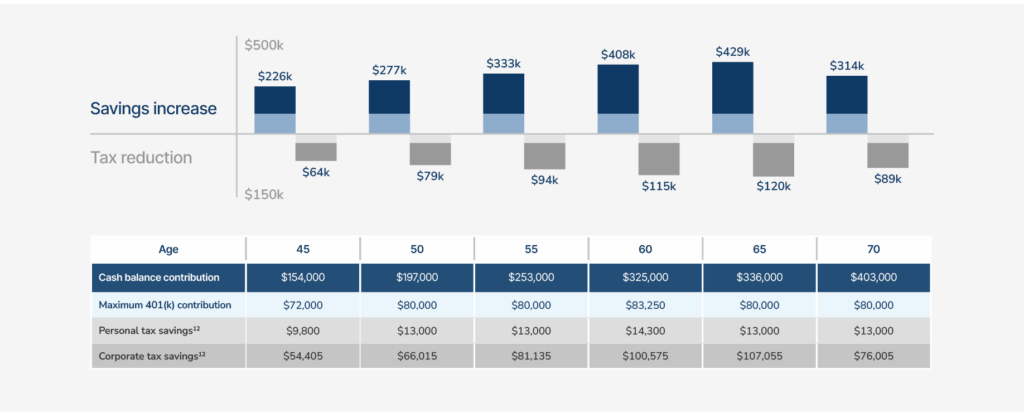

Increased Savings, Decreased Taxes

*Based on a 70-year-old business owner putting away $23,500 in individual contribution, $7,500 as a catch-up contribution, $46,500 as profit sharing, and $403,000 as Cash Balance per 2025 contribution limits.

Why It Works

Normally, retirement plans must treat owners and employees equally. But this combo is different. It’s designed to give owners the biggest benefit—while still helping employees save. And yes, it’s all approved by the IRS.

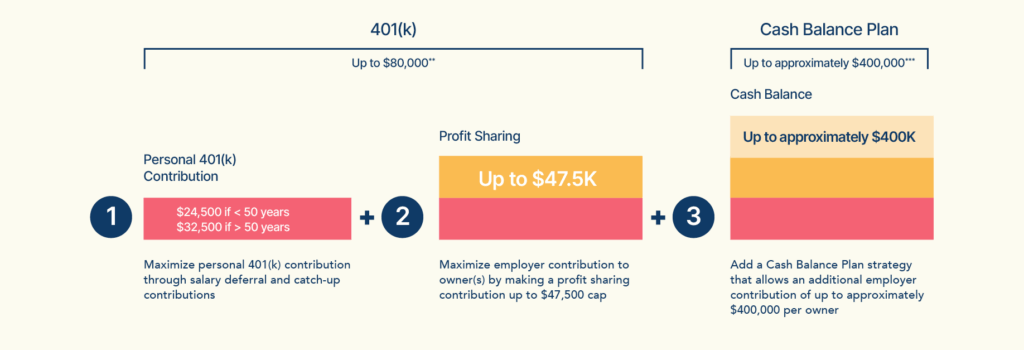

Step 1: Max Out Your 401(k) With a Safe Harbor

Start with a Safe Harbor 401(k). It helps you avoid compliance testing and lets you contribute the full amount—even if your employees don’t. Here’s how you build up to $77,500 (or $70,000 for those under age 50):

- Salary deferral ($23,500/$31,000)

- Catch-up (if you’re 50+)

- Employer match

- Profit sharing

This is your foundation. But if your business has strong profits, you can go even further.

**2025 annual contribution limits are age-based

***2025 includes 401(k) salary deferral and Safe Harbor contributions in addition to profit sharing contributions

Step 2: Add a Cash Balance Plan

This is where the magic happens. A Cash Balance Plan is a type of pension plan. It lets you make large, tax-deductible contributions straight from your business profits. These contributions grow tax-deferred and can be much higher than what a 401(k) allows.

For example, in 2025, you could save up to $480,500 depending on your age. And yes—this comes right off your business income, reducing your taxes. You’re using money you would have otherwise paid in taxes to fund a sizable portion of your retirement savings.

Step 3: Know the Rules

Cash Balance Plans are powerful, but they come with rules:

- You must keep the plan for at least 3 years

- You must contribute 7–9% for covered employees

- You must cover at least 40% of employees

- You must guarantee an annual return (usually 3–5%)

- You’ll need an actuary to help manage the plan

As with any investment in securities, there is a risk of loss with this type of plan. If the plan underperforms, you’ll need to make up the difference—but you’ll have up to 7 years to do it.

While Cash Balance Plans cost more to run, the tax savings and retirement contributions can far outweigh the expense—especially for owners. And according to IRS rules, you can build up to about $3.5 million in your account before you are required to stop contributing to the plan.

Ready to Learn More?

We’ll walk you through everything—from calculating your savings to setting up the plan. We’ll work with your CPA and plan designer to make it easy. Contact Fisher\SMBTM today to get started.

Learn More

Additional Tax Savings Resources

Tax Savings Guide

What if you could move $250,000 or more directly from your business profits to your retirement savings, pre-tax? With the right retirement plan in place, the IRS says you can.

The Critical Role Your 401(k) Can Play in Your Tax Strategy

Learn more about where to look to find tax savings in your retirement plan and how our retirement plan tax services can help you save more.

How a Diversified 401(k) Can Cut Your Taxes

Split your 401(k) between traditional and Roth to lower taxes and boost retirement income. Learn how a diversified 401(k) strategy can save you more money in your retirement plan over time.