8 Questions to Ask When Evaluating a Plan Advisor

Thank You

Click the button below to begin your download, please contact us if you have any questions.

Hire an advisor, get a partner.

Single point-of-contact, preferred pricing, top-tier support — we believe that what big corporations get should be available to everyone.

Explore Our Services

Fisher\SMB strives to redefine what it means to be a partner in retirement by offering a range of employer services.

Investment services for small companies that think big.

Offer your employees a wide variety of high-quality investment options at lower fees than the industry average.

The future is too big to leave to chance.

That’s why we partner with you to offer a range of services that help your employees understand their retirement benefits and maximize their outcomes.

Some call us service obsessed. We call it business as usual.

Do it yourself or let us do it for you – we can help you streamline plan administration to save you time and reduce risk.

Accountability isn’t just our feeling – it’s our legal duty.

Reduce the risks to you and your company. Work with an experienced advisor who puts your interests first.

MUST-SEE ONE-MINUTE VIDEO

Investment Solutions

From ‘Do It for Me’ to ‘Do It Myself,’ Fisher\SMB™ offers a wide variety of investment solutions to meet the needs of plan participants.

| Visual | Audio |

|---|---|

| Fisher\SMB™ logo enters | Upbeat music |

| Three Icons on the screen with: Do it for Me Guide Me Inform Me Do it Myself Below the icons | Female Voice: “We provide services others can’t or won’t provide like superior plan and investment guidance from do it for me, to do it myself Fisher\SMB offers a wide variety of investment solutions to meet the needs of plan participants. |

| The “Do it for Me” icon appears | For those who prefer a hands-off approach and do not want to be involved in the selection and management of their investments, Fisher\SMB will implement an investment plan based on each participant’s age. |

| The “Guide Me” icon appears | For those looking for a guided approach to investment selection, Fisher\SMB will provide ongoing asset allocation guidance to support participants in their investment management. |

| The “Inform Me” Icon appears | For experienced investors who prefer to develop their own plan, Fisher\SMB will provide an education based approach to help participants create their investment plan. |

| The “Do It Myself” Icon appears | For sophisticated investors who have the knowledge and time to dedicate to research, or are working with a personal investment advisor, Fisher\SMB can support a self-directed brokerage account with over 16,000 funds and stocks to choose from. |

| Investing in securities involves the risk of loss. Intended for use by employers considering or sponsoring retirement plans; not for personal use by plan participants. Fisher Retirement Solutions®, Fisher\SMB™, FisherSMB™, and all related logos and designs are trademarks of Fisher Retirement Solutions, LLC, which is not connected to Fisher Investments. ©2025 Fisher Retirement Solutions | No matter what investment solution you choose, Fisher\SMB is with you every step of the way. |

MUST-SEE ONE-MINUTE VIDEO

Employee Services

Our high-touch, wealth-generating employee service model enables better employee outcomes.

| Visual | Audio |

|---|---|

| Fisher\SMB™ | Upbeat music |

| A white screen with a blue outline of a person appears on screen with the thought bubble and inside the thought bubble is a palm tree. The person and the thought bubble disappears and in its place a circle with an outline of three people in the center, and a board with an arrow pointing up animates on screen. the outside circle spins and inside an outline of two people sitting at a table appear on screen. The outside circle spins to change the inside graphic to a document with a pie chart and graph. The outside circle spins again to reveal a percentage chart. The screen turns to blue with the graphics 46% higher participation and 80% deferral rates on screen. at the bottom of the screen a disclaimer reads *Average increases as of 12/31/2021 | Female Voice: “You want your employees to be setup for a successful retirement. While many advisors offer cookie-cutter group education and enrollment meetings, Fisher offers one on one enrollment sessions where retirement counselors meet to help participants create an investment strategy that is unique to their individual goals and provide guidance to help participants to tailor asset and sub asset allocation based on their individual goals. As a result Fisher has 46%* higher participation and 80%* higher deferral rates. |

| Investing in securities involves the risk of loss. Intended for use by employers considering or sponsoring retirement plans; not for personal use by plan participants. Fisher Retirement Solutions™, Fisher\SMB™, FisherSMB™, and all related logos and designs are trademarks of Fisher Retirement Solutions, LLC, which is not connected to Fisher Investments. ©2025 Fisher Retirement Solutions | Improvements in participation and savings rates have huge impacts over time. Schedule a consultation to learn more about how Fisher can help your employees save more toward their retirement goals. Schedule a consultation to learn more. |

MUST-SEE ONE-MINUTE VIDEO

Administration Support

Our services focus on doing everything we can for you. From acting as a single point-of-contact for your plan to selecting investments, we provide services that aim to make your job easier.

| Visual | Audio |

|---|---|

| Fisher\SMB™ | Upbeat music |

| Over a white screen a blue outline of a person dissolves on screen, under it it reads “Plan Sponsor”. Above the plan sponsor a small blue box with the words, Adviser and arrows moving better the advisor and the plan sponsor. | Female Voice: “There are two models for managing communication with retirement plan vendors. A typical plan advisor offers a do-it-yourself approach to administrative support where not only do you, or the plan sponsor, have to coordinate with a plan advisor, |

| Blue boxes with the words Payroll, ERISA compliance, Record Keeper, Participants, and Third-Party Administrator appear on screen around the Plan Sponsor. Arrows run between all the blue text boxes and the Plan Sponsor in the center. | but you also have to troubleshoot retirement plan issues with your payroll provider, ERISA compliance provider, record keeper, plan participants and the third party administrator. |

| These move over to the left side of the screen to make room for another Plan Sponsor. Above this Plan Sponsors it reads “Fisher Do It For You Solution” below the Plan Sponsor is reads “Fisher Solution” Under the Fisher Solution are the blue text boxes that read Payroll, ERISA compliance, Record Keeper, Participants, and Third-Party Administrator. Arrows run between the Fisher Solution and the Text boxes. And then arrows move from Fisher Solution to the Plan Sponsor. | Fisher offers a Do It For You solution. Which focuses on doing everything we can for you. From acting as a single point of contact for your plan, to fielding participant questions. We provide services that many other advisers can’t or won’t provide and if we can’t do it for you, we’ll be there each step of the way to do it with you. |

| Investing in securities involves the risk of loss. Intended for use by employers considering or sponsoring retirement plans; not for personal use by plan participants. Fisher Retirement Solutions™, Fisher\SMB™, FisherSMB™, and all related logos and designs are trademarks of Fisher Retirement Solutions, LLC, which is not connected to Fisher Investments. ©2025 Fisher Retirement Solutions | Schedule a Consultation to learn more. |

Downloadable Checklist

What to Ask When Evaluating a Plan Advisor

Find out the eight most critical questions to ask when evaluating a new plan advisor for your business.

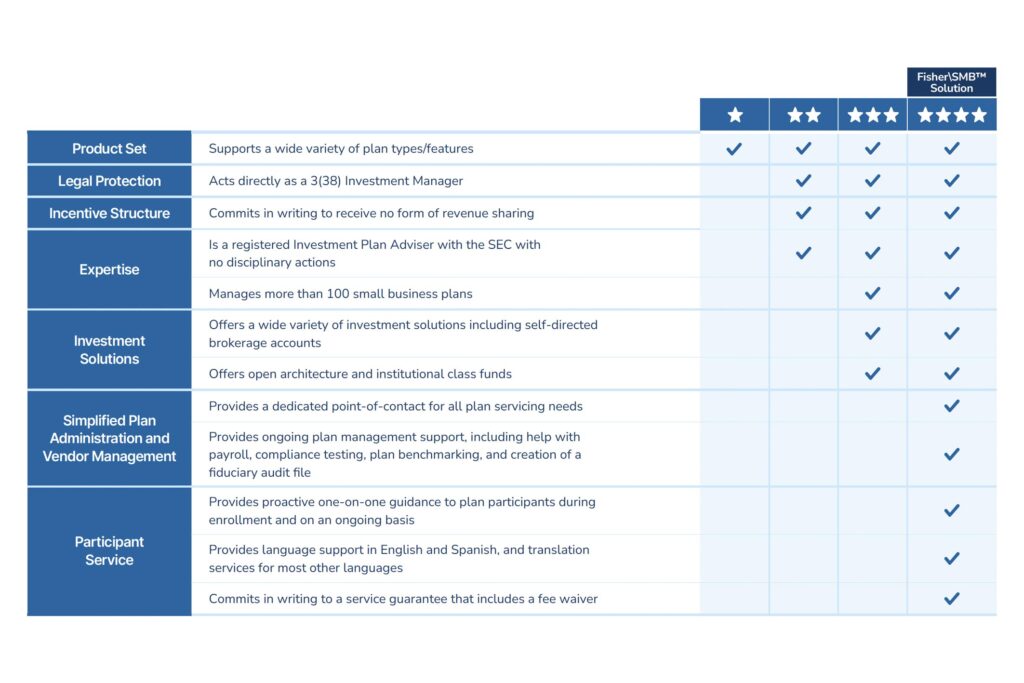

Downloadable Chart

Service Comparison

Compare the differences between the services Fisher\SMB offers to other plan providers.

Contact Us

One of our 401(k) business specialists would love to talk to you about your company’s retirement plan needs.

Call Us

(844) 238-1247